If your sustainability strategy is weak, don’t be surprised if your firm has to jump through hoops to secure funds. A strong strategy breaks down barriers.

It’s all about good relationships.

The degree to which sustainability stimulates value creation is a question that has been examined by executives and investors alike. Does sustainability simply raise a firm’s costs? Or can it really generate revenue?

Researchers Beiting Cheng and George Serafeim of the Harvard Business School, and Ioannis Ioannou of the London Business School, link corporate social responsibility (CSR) activities to positive implications for a firm’s bottom line.

In their article, “Corporate Social Responsibility and Access to Finance,” they present how sustainable activities improve a firm’s access to finance and reduce capital constraints.

Unraveling the Funding Conundrum

When a firm’s access to funding is reduced – perhaps due to illiquidity, credit and borrowing issues, or poor equity performance – it can have serious implications for strategic decisions. Major investments and important projects become more difficult to finance. A firm’s capital structure – and even stock performance – can be compromised.

With eight years of data across 49 countries, the researchers formed a large sample of more than 10, 000 firm-year pairs. The firms spanned various industries such as transportation, sanitation, utilities, and manufacturing. For every year, firms were assigned performance-based scores in each of three pillars: social, environmental, and corporate governance (data were obtained from Thompson Reuters ASSET4). The final variable is a firm-year pair with a three-part score that reflects each firm’s annual commitments to corporate responsibility and governance.

Strong Sustainability, Secure Funds

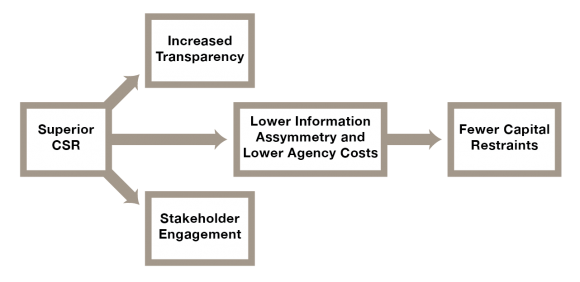

Based on image by Ioannis Ioannou, London Business School

Firms with strong sustainability strategies encounter fewer hurdles in securing funding sources through, for example, a greater ability to issue equity or obtain bank loans. There are two main reasons why:

1. Firms with effective sustainability prioritize their stakeholders.

Better sustainability performance is linked to superior stakeholder engagement. Firms with strong sustainability strategies who meaningfully engaged their customers, shareholders, and employees, were significantly more likely to have greater access to finances and less capital constraints.

The researchers posit this is due to factors like reduced agency costs and greater revenue generation. These are the fruits of cultivating and maintaining high quality relationships with key stakeholders who value sustainability as a part and parcel of good corporate citizenship.

2. Firms with effective sustainability prioritize transparency and disclosure.

The study found that firms with strong sustainability strategies are better at communicating their environmental and social plans and ideas to the public and other important stakeholders. Simply put, they’re good at reporting.

Increasing transparency and accountability builds trust and minimizes risk perception through what the authors call “reduced informational asymmetry”. This aligns with research findings from Vasi and King (2012) in which they discuss how the mere perception of risk by stakeholders and investors can translate into tangible financial loss for a firm.

Firms with better sustainability who disclosed their strategies to pivotal stakeholders enjoyed higher stakeholder trust and lower capital access restraints.

Sustainability leads to Rewarding Relationships and Positive ROI.

If your sustainability strategy is ineffective, weak, or non-existent, your firm will have to jump through many more hoops to secure funding.

A strong sustainability strategy creates value by breaking down barriers to capital and funding sources and building fruitful relationships with stakeholders.

Your firm has a higher chance of accessing financial resources and improving cash flow if it adopts a sustainability strategy that is engaging and transparent.

Cheng B, Ioannou I and Serafeim, G. 2014. “Corporate Social Responsibility and Access to Finance.” Strat. Mgmt. J.35: 1–23.

Add a Comment

This site uses User Verification plugin to reduce spam. See how your comment data is processed.This site uses User Verification plugin to reduce spam. See how your comment data is processed.